Trade Commodities with Traderpointfx247.

Trading commodities CFDs ("contracts for difference") is a great way to diversify your portfolio and hedge risks. Traderpointfx247. has carved a niche for itself in the commodity trading market in Australia, offering the optimal trading experience.

Choosing from a wide variety of products, while benefiting from the latest real-time technology and available commodity prices. When you choose to trade commodity CFDs with Traderpointfx247., you get access to commodity prices worldwide with high execution speeds, low slippage,deep liquidity and tight spreads.

Trade CFDs on a wide variety of global commodities, including gold, silver and oil with an Global-regulated broker provider giving you access to different asset classes on the same platform or a range of platforms as well as sophisticated risk management tools and trading tools.

What are the benefits of commodities trading?

- Leverage up to 500:1

- Choose from a wide range of commodities, such as energy, metals and agricultural products

- Enter and exit trades whenever you want to, 24/5, across almost all commodities markets

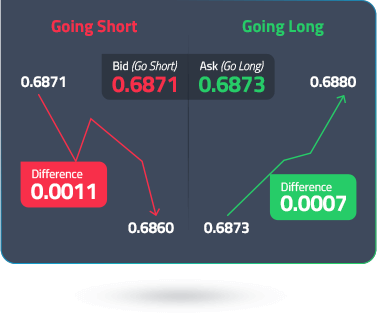

- Trade in any direction you think the markets will go, short or long, maximising trading opportunities

- No price manipulation and no requotes

- Hedge Risks - Hedge your investment risks with high value assets, like gold and silver

- Benefit from low margin, low-cost trading, without compromising execution

What is the best Platform to trade Commodities?

Discover the benefits of Commodities trading on one of the most powerful trading platforms available, MetaTrader 4 (MT4). Available across desktop and mobile platforms the MetaTrader 4 platform is ready when you are.

- Spreads from 0.0 pips & leverage up to 500:1

- Customisable interface, including colours of technical indicators

- One-click trading

- Live price streaming on Live accounts and Demo accounts 128-bit encryption for secure trading

- Expert Advisors (EAs)

- Customisable alerts

- Compatible with iOS, Android and Mac devices

What is Commodities Trading?

Commodities trading represents the buying and selling of set quantities of homogeneous, or near-homogeneous assets. Popular commodities include Brent Crude Oil, Gold and other precious metals and soft commodities such as coffee, cocoa, soya etc. Price movements in commodities are usually seen as bellwethers for the overall health of the industry that produces/consumes them.

Commodity prices can be impacted by factors such as adverse weather, seasonal availability, natural disasters and other non-market factors typically found in other financial instruments. Typically, commodities trading in commodities can be either speculative or for hedging purposes. Traders can trade commodity markets to express their outlook on certain industries or to hedge their trading portfolio.

Through careful analysis, CFD traders predict the potential direction of commodities prices and attempt to capture gains based on price fluctuations. The market is open 24 hours a day, 5 days a week.

An Example of Leveraged CFD Commodities Trading

Suppose you want to trade CFDs, where the underlying asset is the XTIUSD a commodity, also known as Crude Oil. Let us suppose that the XTIUSD is trading at:

You decide to buy 2,000 barrels of XTIUSD because you think that the XTIUSD price will rise in the future. Your margin rate is 10%. This means that you need to deposit 10% of the total position value into your margin account.

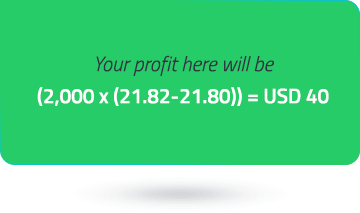

Now, in the next hour, if the price moves to 21.82 /21.90, you have a winning trade. You could close your position by selling at the current price of USD 21.82

In this case, the price of crude oil moved in your favor. But, had the price declined instead, moving against your prediction, you could have made a loss. If that loss reduced your free equity to less than USD 4360.00, your broker would have issued a margin call and will close all your trades if the equity falls at 50% of 4360.